[Customer acquisition cost (CAC) = (£sales + £marketing) / Customers acquired]

One of the biggest challenges early stage start-ups see is gaining customers at the right price, getting the right CAC. The challenge for scale-ups is keeping control of that customer acquisition cost. It often happens that as the business grows, so does the CAC.

CAC rises because systems, focus, and leadership change at scale, not because marketing suddenly “breaks”.

If you’re seeing rising CAC as you scale, realise you are not alone.

It happens to a lot of businesses. It doesn’t necessarily mean marketing is failing or out of control, neither does it have to mean your sales commissions are wrong.

For a full understanding of how to calculate CAC and its use alongside other core metrics, check out:

Customer Acquisition Cost (CAC): The Metric Every Growth Business Needs to Track

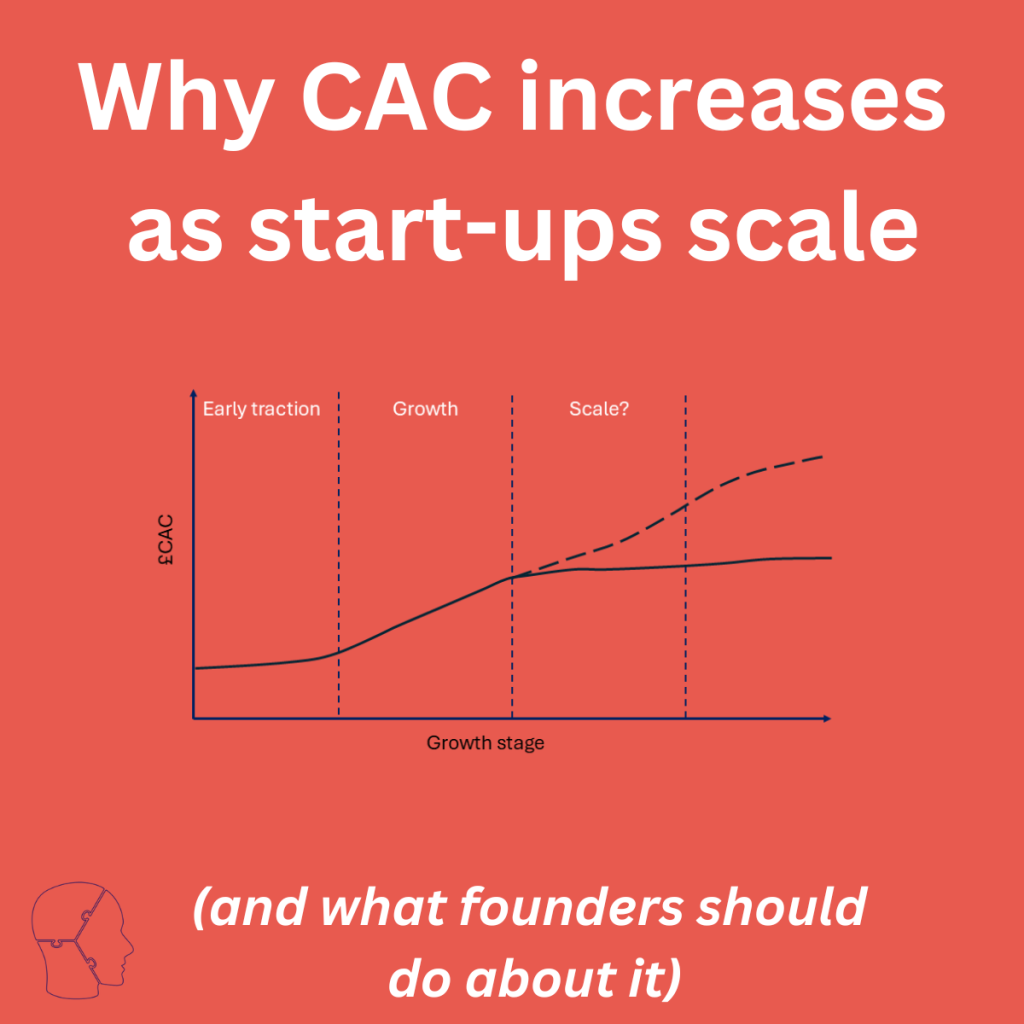

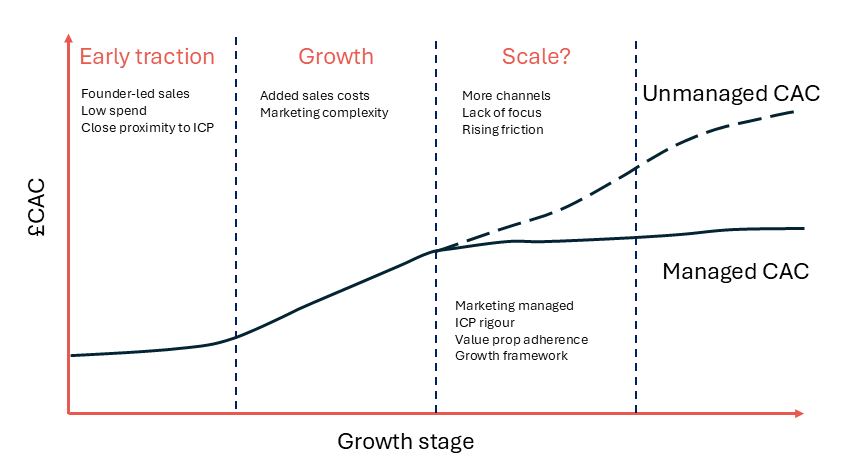

CAC behaves differently once you move past early traction

Getting to traction is often the story of acquiring customers at the right price.

However, scaling can sometimes be the story of CAC spiralling out of control.

Early in the business, CAC can be artificially low.

This doesn’t mean you don’t work hard for early customers, but simply that you don’t spend much on acquiring them.

> Your first customers are often enthusiastic advocates (early adopters love to tell people about their great finds).

> Much of the sales work is often done by founders themselves (and as founders don’t see themselves as sales people, don’t include their time cost in CAC calculations, neither do they actually pay themselves much).

> Early marketing is focused on low-hanging fruit. Successful early stage businesses understand their core ICP in depth and can get close to them.

From the moment you hire a Business Development or sales person or an acquisition-facing customer service agent, and start paying salaries (+ commission + employment taxes + more), CAC starts to increase. This is when you start to discover the true cost of acquisition.

Most founders realise this and factor it in. That rise in CAC associated with sales hires is predictable (and partly offset by the additional new customers these people will bring in or facilitate).

However, there are other costs that start to mount that influence CAC and cause greater frustration to founders.

The most common reasons CAC increases with scale

ICP dilution

To gain traction, businesses need to identify their Ideal Customer Profile (ICP). Having a deep understanding of who your best customer is, their needs and the problems they face, is the way to build traction.

To find out more about ICPs, check the article

5 Steps to Building a Profitable ICP

One of the best ways of really focusing early marketing and sales activity is using the concept of what Seth Godin calls the “minimum viable audience“. This helps acquire customers cheaply.

However, as you scale:

- Your target audience broadens (deliberately or otherwise)

You may choose to broaden your audience to reach a wider market, but this will reduce focus unless done very carefully.

Reduced focus means less effective marketing activity which increases CAC.

Sometimes this happens accidentally; focus just slips. Rising CAC could be the symptom that highlights the issue here. - Messaging doesn’t land with a more diverse audience

Early messaging – if done well – lands with the tightly defined ICP audience. It addresses their needs and problems head on. As the audience broadens, the old message doesn’t land so well with the new audience members. - Conversion rates fall

When messaging doesn’t land, conversion rates will fall. You may deliver more people to a landing page or to your sales catalogue given the broader audience, but if conversion rate dips, CAC can accelerate quickly. I’ve seen people try to remedy this by adding more to their landing pages, ultimately reducing conversion further.

Marketing becomes broader and weaker

It’s not just the broadening of the ICP that causes messaging and brand weakness. Bad habits often slip in.

- Outcomes become replaced by features

As the volume of marketing content increases across multiple channels (social media, website, PR, sales collateral, campaigns etc) discipline becomes eroded and marketing copy can often slip back into being feature-led rather than focusing on outcomes. It’s a sure-fire way to dilute conversion rates and overall marketing impact – again increasing CAC - Control is lost

If marketing loses control of content – if sales or service staff publish – the carefully crafted message can easily diminish.

Check out my piece

The Marketing Messaging Hierarchy: Why Outcomes Beat Features and Price

Channel saturation and diminishing returns

It’s a worrying time for marketers when they start to sense they may be maxing-out a particular channel.

It happened to me when I was a marketing director – we did a great job on PPC, winning many battles for prime and long-tail keywords, with exceptional on page conversion rates. But slowly I started to see slightly diminishing returns. The competition was getting hotter, CPC started to increase, conversion rates didn’t improve. Any new long-tail keywords were so long-tail, we struggled to monetise them seriously. We had reached a point of channel saturation. Fortunately, I monitored CAC closely and could see it starting to happen, so I was able to take action and start to diversify channels.

- Over-reliance on a single channel makes you vulnerable

Competitor action or customer fatigue can create real issues for CAC - Paid channels are particularly high risk

CPC can escalate quickly, and a lack of attention to ICPs and messaging can reduce conversion rates, having a big impact on CAC overall - Organic focus can be on the wrong metrics

Traditionally, organic traffic has been measured on volume. But volume counts for nothing without action – focusing your activity on organic volume that doesn’t convert will seriously impact your CAC

Sales and marketing misalignment

As the business grows, so teams grow – and they are in danger of becoming ever more isolated and siloed. Marketing needs to build relationships across the organisation – with finance, with product, with customer success and customer service and above all, with sales.

When sales and marketing pull in different directions, if effort is duplicated (or wasted), CAC increases.

When rising CAC is healthy (and when it's dangerous)

Not all increases in CAC are bad. Remember the most important metric is not CAC per se, but the relationship between CAC and Lifetime Value (LTV) – the LTV:CAC ratio is the one that enables your business to scale sustainably.

✅ Healthy CAC increases

It’s OK if CAC rises if:

- Revenue per customer increases as fast (or faster)

If you can sell more products to your customer or charge more for them, it justifies an increase in acquisition cost - Retention improves

Improved retention increases Lifetime Value (assuming you don’t use heavy discounts as a save tool) - Contribution margin holds steady (or improves)

This is the difference between revenue and the cost to service the customer – often more customers deliver economies of scale when it comes to variable costs, meaning you can tolerate a higher CAC - Sales cycles become more predictable

A big increase in predictability and forecasting accuracy can be worth a small increase in CAC.

❎ Dangerous CAC increases

It’s not OK if CAC rises if:

- Volume is chased at any cost

Old enough to remember the dot.com boom and bust? Volume is important, of course. However, sustainable long term growth should be your target. Runways have a habit of shortening fast when you’re chasing volume. - The wrong customers come on board

Some customers are expensive to serve – whether you’re a retail business or an enterprise solutions provider, some customers are better than others. If CAC is increasing and loyalty declining, you’re in a downward spiral. - ICP is unclear or shifting

If CAC is increasing and focus is shifting or damaged, it can be hard to get back on track - More spend, same results

The most insidious change to CAC comes without any real awareness from marketing as to why – it creeps up on you. Typically, it doesn’t come from a lack of work, it comes from a lack of focus (on the customer, on the channel, on the messaging…)

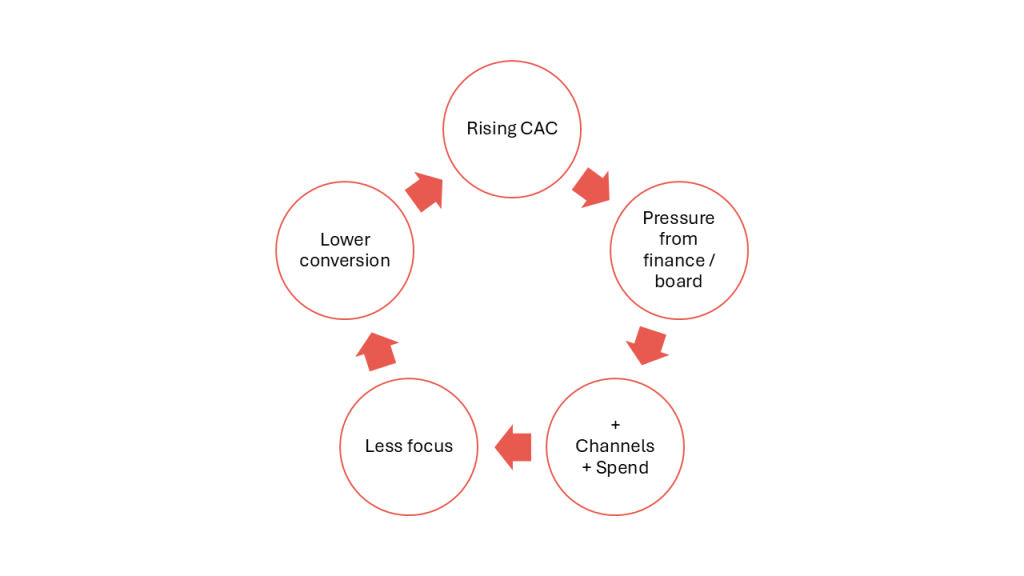

How founders accidentally make CAC worse

When CAC increases (particularly when the LTV:CAC ratio gets worse), there can be a tendency to panic. I’ve heard it before from CFOs: “marketing is out of control!”.

Often the founder steps in. And here’s what I’ve seen play out:

- Channels are added, but fundamentals not fixed

Founders might hear that Facebook is working for a competitor, or a peer suggests trying a cold email campaign, or someone offers a deal on a newspaper supplement. It seems like it might be the answer to their prayers, something new and different. However, 9 times out of 10 (or more), it simply increases CAC and doesn’t bring in the right new customers.

This doesn’t mean new channels can’t work, but they need to be part of a bigger plan – one that includes re-assessing the ICP, value proposition and the messaging. - Hiring execution before leadership

If PPC isn’t delivering anymore, it can be a temptation to go out and hire a performance marketing specialist. That might help temporarily but again doesn’t address the fundamental issue. When there is trouble, every £1 spent on leadership will show a better return than £1 spent on execution. - Lack of strategic framework thinking

Without a framework (such as the SOPE Framework), marketing becomes tactical and optimisation happens at the edges, not with the fundamentals.

How to stabilise CAC as you scale

You won’t deliver a stable CAC by tinkering at the edges and through tactical solutions. Hacks won’t work. Here’s what will:

- Ruthless adherence to your ICP

Note that in time your ICP will change. You may wish to add multiple ICPs as you scale. But for each one, you have to understand who they are, what their motivation is, what the problem is that you solve. Every piece of content, every campaign, every conference speech, every press release needs to have your ICP in mind. It takes real discipline. - Razor sharp value proposition

The value proposition needs to be owned. It needs to be constantly tested to see that it resonates. And again, every piece of content needs to reflect and support the value proposition. - Framework thinking

Having a framework in place gives you structure, it ensures that you have the right strategy, organisation (skills and tools), processes and execution in place. A framework helps keep you and the business on track. - Focus on fewer priorities

Pick your channels wisely, focus on executing as well as you can, learn from every activity. - Ensure you have the right marketing leadership in place early enough

While you may not need full-time leadership, experience and strategic expertise are vital as you scale your business.

For a scaling business, CAC is a leadership metric

Once you reach traction and have a platform for scale, CAC ceases to be an interesting marketing metric. It becomes a vital leadership metric.

Understanding, measuring and managing CAC (and its partner metric LTV) helps you:

- Set, deliver and manage your strategic ambitions

- Build an organisational structure that delivers value

- Create the processes that will provide strategic growth and momentum

- Focus on executing marketing to the best of your ability

If your CAC is rising and you’re unsure if it’s normal, healthy or damaging or a sign of something deeper, that’s a leadership conversation, not a channel optimisation exercise.